Master Your Credit Score: Proven Strategies for Financial Improvement

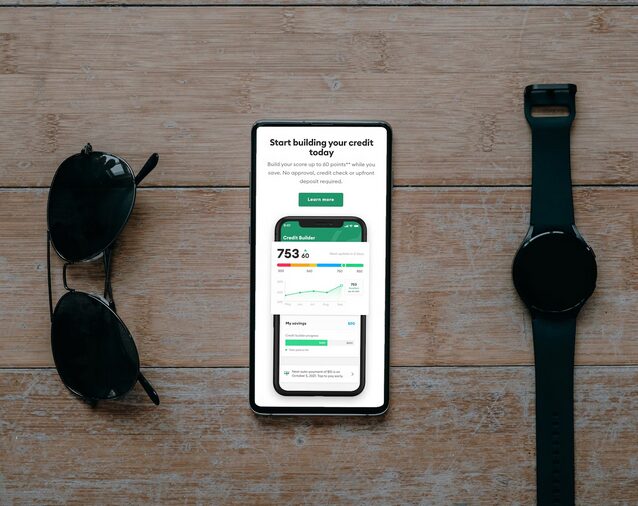

Are you ready to unlock the door to financial freedom? Your credit score is more than just a number; it’s your ticket to better loan rates, lower insurance premiums, and even job opportunities! But if you’ve felt overwhelmed or confused about how to boost that all-important figure, you’re not alone. Fear not—this blog post is here to demystify the world of credit scores and arm you with proven strategies for improvement.

Whether you’re starting from scratch or looking to polish an already decent score, we’ve got practical tips and expert insights that will empower you on your journey toward mastering your credit. Let’s dive in and transform your financial future together.

Know What a Credit Score Is

First off, let’s clear the air. Your credit score is a three-digit number that reflects your creditworthiness. Lenders, landlords, and even some employers use it to gauge how likely you are to repay borrowed money. Scores typically range from 300 to 850, with higher scores indicating better credit health. Most lenders consider a score above 700 to be good, while anything below 600 may raise some eyebrows.

Your credit score matters for several reasons. It can determine whether you qualify for loans and credit cards, influence the interest rates you’re offered, and even affect your ability to rent an apartment. The higher your score, the better your chances of securing favorable terms on loans, which can save you money in the long run.

Check Your Credit Report Regularly

The first step to improving your credit score is knowing where you stand. Check your credit report regularly for free through websites like AnnualCreditReport.com. This report will detail your credit history, including payment history, outstanding debts, and your credit accounts. Keeping an eye on your report will help you spot any errors or signs of fraud that could negatively impact your score.

Pay Your Bills on Time

One of the most critical factors in determining your credit score is your payment history. Late payments can significantly damage your score, so paying your bills on time is essential. Set reminders on your phone or use automatic payments to help you stay on track. If you have difficulty remembering, you could even consider a budgeting app that tracks your bills and expenses.

Keep Your Credit Utilization Low

Credit utilization refers to the amount of credit you use compared to your total available credit. Ideally, you want to keep your utilization ratio below 30%. For example, if you have a credit limit of $10,000, try to keep your outstanding balance under $3,000. High utilization can signal to lenders that you might be overextending yourself, which could hurt your score. If you find yourself close to that 30% mark, consider paying down your balance or requesting a credit limit increase.

Diversify Your Credit Mix

Having a mix of different types of credit can also positively impact your score. Lenders like to see that you can handle various types of credit, such as credit cards, auto loans, and mortgages. However, this doesn’t mean you should rush to open several accounts simultaneously. Instead, focus on managing your credit responsibly and only consider new accounts when necessary.

Avoid Opening Too Many Accounts at Once

While diversifying your credit mix is helpful, opening too many accounts in a short period can raise red flags. When you apply for credit, a hard inquiry is recorded on your report, which can temporarily lower your score. If you’re shopping around for a loan, try to do it quickly so that multiple inquiries count as one. This is particularly true for mortgage and auto loan applications.

Be Patient and Stay Consistent

Improving your credit score is not an overnight process. It takes time and consistent effort. Stay patient and keep working on your financial habits. Celebrate small victories along the way, whether it’s paying off a credit card or successfully disputing an error on your report. Remember, it’s all about progress.

Credit scores may seem complex, but with the proper knowledge and strategies, you can take control of your financial health. By checking your credit report regularly, paying your bills on time, managing your credit utilization, and being mindful of your credit mix, you’ll be well on your way to improving your score. So, roll up your sleeves, take action, and watch your financial health flourish! With time and dedication, you can demystify your credit score and pave the way for a brighter economic future.

Traditional banks have been a cornerstone of the financial world for centuries, offering borrowers a tried and tested avenue for loans. These brick-and-mortar institutions are known for their stability, with established systems and processes in place to guide you through the loan application process. Additionally, traditional banks often have strict regulations in place, providing a sense of security for borrowers. However, with this stability comes a few drawbacks.

Traditional banks have been a cornerstone of the financial world for centuries, offering borrowers a tried and tested avenue for loans. These brick-and-mortar institutions are known for their stability, with established systems and processes in place to guide you through the loan application process. Additionally, traditional banks often have strict regulations in place, providing a sense of security for borrowers. However, with this stability comes a few drawbacks. The rise of technology has paved the way for online lenders, offering borrowers an alternative option for fast loans. These digital platforms have streamlined the loan application process, making it faster and more convenient for borrowers. With minimal paperwork and easy online applications, borrowers can receive funds in a matter of days rather than weeks. Additionally, online lenders often have more lenient eligibility requirements, making securing a loan easier for those with less-than-perfect credit scores or limited collateral. However, online loans’ fast and convenient nature comes at a cost. Interest rates may be higher than traditional banks, and there is always a risk of falling prey to fraudulent lending practices.

The rise of technology has paved the way for online lenders, offering borrowers an alternative option for fast loans. These digital platforms have streamlined the loan application process, making it faster and more convenient for borrowers. With minimal paperwork and easy online applications, borrowers can receive funds in a matter of days rather than weeks. Additionally, online lenders often have more lenient eligibility requirements, making securing a loan easier for those with less-than-perfect credit scores or limited collateral. However, online loans’ fast and convenient nature comes at a cost. Interest rates may be higher than traditional banks, and there is always a risk of falling prey to fraudulent lending practices. When it comes to choosing between traditional banks and online lenders for fast

When it comes to choosing between traditional banks and online lenders for fast

Don’t settle for the first loan offer you receive. Take the time to shop around and compare loan terms from multiple lenders. Online marketplaces and loan comparison websites can assist you in finding the best interest rates, repayment schedules, and fees.

Don’t settle for the first loan offer you receive. Take the time to shop around and compare loan terms from multiple lenders. Online marketplaces and loan comparison websites can assist you in finding the best interest rates, repayment schedules, and fees.

The first step towards saving money is creating a budget outlining your income and expenses. Track your spending habits for a month to understand where your money is going. Categorize expenses into essential and discretionary items. Essential expenses include rent/mortgage, utilities, groceries, and debt payments, while discretionary expenses include dining out, entertainment, and shopping. Identify areas where you can reduce non-essential spending and redirect those funds toward savings.

The first step towards saving money is creating a budget outlining your income and expenses. Track your spending habits for a month to understand where your money is going. Categorize expenses into essential and discretionary items. Essential expenses include rent/mortgage, utilities, groceries, and debt payments, while discretionary expenses include dining out, entertainment, and shopping. Identify areas where you can reduce non-essential spending and redirect those funds toward savings.

Being a mindful shopper can save you money every month. Always compare prices before purchasing, and consider waiting for sales or discounts to buy non-urgent items. Purchasing in bulk can lead to cost savings on frequently used products. Use rewards programs, cashback offers, and coupons to stretch your dollar further. Being proactive about finding deals and discounts can significantly affect your monthly expenses. Also, save at least three to six months of living expenses in your emergency fund.

Being a mindful shopper can save you money every month. Always compare prices before purchasing, and consider waiting for sales or discounts to buy non-urgent items. Purchasing in bulk can lead to cost savings on frequently used products. Use rewards programs, cashback offers, and coupons to stretch your dollar further. Being proactive about finding deals and discounts can significantly affect your monthly expenses. Also, save at least three to six months of living expenses in your emergency fund.

The first step to getting out of debt is to create a spending plan. It will help you see where your money is going and where you can cut back. It may be challenging to do this at first, but it is essential to getting out of debt. You can use a budgeting app, create a spreadsheet, or use a notebook. Once you have made your spending plan, start tracking your expenses. It will help you see where your money is going and where you can cut back. You may be surprised to find that you are spending more than you thought on things that you don’t need.

The first step to getting out of debt is to create a spending plan. It will help you see where your money is going and where you can cut back. It may be challenging to do this at first, but it is essential to getting out of debt. You can use a budgeting app, create a spreadsheet, or use a notebook. Once you have made your spending plan, start tracking your expenses. It will help you see where your money is going and where you can cut back. You may be surprised to find that you are spending more than you thought on things that you don’t need. When you are trying to get out of

When you are trying to get out of

It would help if you considered the interest rates before taking a loan. Depending on the type of loan you are applying for, there can be different interest rates for various loans. For example, home mortgages typically have lower interest rates than credit card debt or car financing because lenders don’t want to risk losing money when someone defaults on their payment. Different loan lenders will set their own interest rates, so do your research before applying.

It would help if you considered the interest rates before taking a loan. Depending on the type of loan you are applying for, there can be different interest rates for various loans. For example, home mortgages typically have lower interest rates than credit card debt or car financing because lenders don’t want to risk losing money when someone defaults on their payment. Different loan lenders will set their own interest rates, so do your research before applying. It will be wise to calculate your debt-to-income ratio before taking a loan. Based on your income, this will help you understand how much monthly debt payments you can afford. Your DTI should not exceed 43%. This means that your total monthly obligations (including the new loan payment) should not be more than 43% of your gross monthly income.

It will be wise to calculate your debt-to-income ratio before taking a loan. Based on your income, this will help you understand how much monthly debt payments you can afford. Your DTI should not exceed 43%. This means that your total monthly obligations (including the new loan payment) should not be more than 43% of your gross monthly income.

The cost savings from using an outsourced pay stub maker will add up over time, giving you more money in your pocket at the end of each month.

The cost savings from using an outsourced pay stub maker will add up over time, giving you more money in your pocket at the end of each month. Despite being able to save time by using an outsourced paystub creator service, you are still required to put in some effort into finding the best company for your needs.

Despite being able to save time by using an outsourced paystub creator service, you are still required to put in some effort into finding the best company for your needs.

One of the main benefits of a signature loan is how quickly and easily you can obtain them easily. The application process doesn’t take long, typically just around ten minutes or so, and you can have the funds deposited directly into your checking account within 24 hours if you are approved. Once you get approved, all that’s left is deciding how much money you want to borrow and what type of repayment schedule works best for your budget. Just make sure you follow all the steps shown on the website.

One of the main benefits of a signature loan is how quickly and easily you can obtain them easily. The application process doesn’t take long, typically just around ten minutes or so, and you can have the funds deposited directly into your checking account within 24 hours if you are approved. Once you get approved, all that’s left is deciding how much money you want to borrow and what type of repayment schedule works best for your budget. Just make sure you follow all the steps shown on the website. Lenders typically require you to repay your signature loan in full at the end of each month, which means consumers can’t make partial payments or set up automatic monthly installments. If you cannot pay off your entire balance, there is no option other than defaulting on the loan and having any remaining amount due sent to a collection agency. So, make sure you can afford the monthly payments before applying for a loan! Another downside of taking out a signature loan is that it’s impossible to make partial payments or set up automatic monthly installments.

Lenders typically require you to repay your signature loan in full at the end of each month, which means consumers can’t make partial payments or set up automatic monthly installments. If you cannot pay off your entire balance, there is no option other than defaulting on the loan and having any remaining amount due sent to a collection agency. So, make sure you can afford the monthly payments before applying for a loan! Another downside of taking out a signature loan is that it’s impossible to make partial payments or set up automatic monthly installments.

The process of forming a limited company is long and tedious and takes lots of time. Given that entrepreneurs have lots of other duties to attend to, they may not manage to handle the company formation well. Working with a company formation agent saves those entrepreneurs time and allows them to focus on their core businesses. It also helps the business persons with other things like financial planning.

The process of forming a limited company is long and tedious and takes lots of time. Given that entrepreneurs have lots of other duties to attend to, they may not manage to handle the company formation well. Working with a company formation agent saves those entrepreneurs time and allows them to focus on their core businesses. It also helps the business persons with other things like financial planning. Entrepreneurs stand to save on several expenses when they hire agents for the formation of their limited companies. The agents offer them much more than the incorporation services because they provide accounting services, cloud accounting software, compliance with various requirements, and so on. They even help to open corporate bank accounts and other crucial services.

Entrepreneurs stand to save on several expenses when they hire agents for the formation of their limited companies. The agents offer them much more than the incorporation services because they provide accounting services, cloud accounting software, compliance with various requirements, and so on. They even help to open corporate bank accounts and other crucial services. Company formation is a legal process and ensuring it maintains its limited status and enjoys the privileges of a limited liability entity needs it to comply with certain things. Business founders can benefit from the legal guidance of the agents because they have legal experts.

Company formation is a legal process and ensuring it maintains its limited status and enjoys the privileges of a limited liability entity needs it to comply with certain things. Business founders can benefit from the legal guidance of the agents because they have legal experts.

Every time a person opens an account, there are various charges one must pay to for maintaining the account. Some charge a monthly fee, while other charge depending on transactions. Also, this fee varies depending on the type of account. However, services like ATM or over the counter withdrawal, salary processing, and statement preparations just to mention but a few, will all have a fee. Banks make a lot of money from this depending on the number of customers they have. No wonder! Banks keep on encouraging people to open accounts with them.

Every time a person opens an account, there are various charges one must pay to for maintaining the account. Some charge a monthly fee, while other charge depending on transactions. Also, this fee varies depending on the type of account. However, services like ATM or over the counter withdrawal, salary processing, and statement preparations just to mention but a few, will all have a fee. Banks make a lot of money from this depending on the number of customers they have. No wonder! Banks keep on encouraging people to open accounts with them. Ever heard of investment banks? Most of them engage in various investment activities to look for more finances. They can trade in securities and engage in real estate among many other investment opportunities. Their investment advisers make very sensitive probabilities as they do not want to risk people’s money. However, most of them make smart ideas and remain profitable out of which their customers benefit in dividends

Ever heard of investment banks? Most of them engage in various investment activities to look for more finances. They can trade in securities and engage in real estate among many other investment opportunities. Their investment advisers make very sensitive probabilities as they do not want to risk people’s money. However, most of them make smart ideas and remain profitable out of which their customers benefit in dividends

try to get a clear understanding of the residential insurance policies and exactly how the particular company comes up with its quotes. Try getting quotes for all coverage that may be related to you, including those that might be unforeseen. Such may include coverage for flood damage or hurricanes, depending on where you live. The idea is to get a basic feel of how the quotes come about, giving you better chances of understanding the home insurance essential elements.

try to get a clear understanding of the residential insurance policies and exactly how the particular company comes up with its quotes. Try getting quotes for all coverage that may be related to you, including those that might be unforeseen. Such may include coverage for flood damage or hurricanes, depending on where you live. The idea is to get a basic feel of how the quotes come about, giving you better chances of understanding the home insurance essential elements. Size/Value

Size/Value

government of USA are ChoiceTrade, Charles Schwab Corb, Interactive Brokers, Scottrade, TradeKing, and TDAmeritrade. You can not go wrong with any of these options with some charging a commission per share and others a flat rate. Be careful to avoid scams, though. If something sounds too good to be true, it probably is not. Anything with low costs and high returns is potentially a fraud.

government of USA are ChoiceTrade, Charles Schwab Corb, Interactive Brokers, Scottrade, TradeKing, and TDAmeritrade. You can not go wrong with any of these options with some charging a commission per share and others a flat rate. Be careful to avoid scams, though. If something sounds too good to be true, it probably is not. Anything with low costs and high returns is potentially a fraud.

to purchasing any equipment? Do you have the finances to buy it? If yes, consider taking a cash advance. A cash advance allows you to buy any equipment. More to this, with a cash advance, you can be sure to make a purchase within the shortest time possible. This will be a great move towards making your business successful.

to purchasing any equipment? Do you have the finances to buy it? If yes, consider taking a cash advance. A cash advance allows you to buy any equipment. More to this, with a cash advance, you can be sure to make a purchase within the shortest time possible. This will be a great move towards making your business successful.

someone does the hard work for you. After all, you didn’t expect to have this money back anytime soon. There are also challenges that come with the process of making a claim. For instance, you might not be able to trace some details about your payments. You might end up not having a clear picture of the amounts owed. Instead, let the company find out this for you, write to your bank and make follow-ups for you.

someone does the hard work for you. After all, you didn’t expect to have this money back anytime soon. There are also challenges that come with the process of making a claim. For instance, you might not be able to trace some details about your payments. You might end up not having a clear picture of the amounts owed. Instead, let the company find out this for you, write to your bank and make follow-ups for you.

These are two things that will help get your credit back on track: on-time payments and credit card balances well below the limit.

These are two things that will help get your credit back on track: on-time payments and credit card balances well below the limit. It will have a lot of things that may not apply to your credit, as such. It will have past employers and businesses that have run checks against your credit. Then there will be the listings of all your consumer accounts and any other types of accounts that you may have.

It will have a lot of things that may not apply to your credit, as such. It will have past employers and businesses that have run checks against your credit. Then there will be the listings of all your consumer accounts and any other types of accounts that you may have.

Look for the best personal loan that offers you the best deal. This means that you should compare your options and go for the best lender. This is a tip that will help you in finding an unsecured loan easily as well as getting the best bargain for your loan. This will be an added advantage considering that you will receive the money at your point of need.

Look for the best personal loan that offers you the best deal. This means that you should compare your options and go for the best lender. This is a tip that will help you in finding an unsecured loan easily as well as getting the best bargain for your loan. This will be an added advantage considering that you will receive the money at your point of need.

negotiate for a car lease deal. In case your credit

negotiate for a car lease deal. In case your credit If it is possible, try to avoid paying the acquisition fee for new car leases and the security deposit. The lease deals on new cars often include an acquisition fee. This cost, however, is something that is added to the car by the car dealer with the sole purpose of taking more money out of your pocket. In case you notice that this fee is added to your contract, make sure that you ask about it before you sign the contract.

If it is possible, try to avoid paying the acquisition fee for new car leases and the security deposit. The lease deals on new cars often include an acquisition fee. This cost, however, is something that is added to the car by the car dealer with the sole purpose of taking more money out of your pocket. In case you notice that this fee is added to your contract, make sure that you ask about it before you sign the contract.

brighton & hove accountants are responsible for creating and maintaining financial records. These files are used in making strategic decisions, filing taxes, preparing annual statements and much more. Besides, chartered accountants operating in Brighton and Hove offer an assortment of experience in tax law, cost accounting, management accounting and use of cloud accounting services. This way, you will benefit from prudent utilization of resources.

brighton & hove accountants are responsible for creating and maintaining financial records. These files are used in making strategic decisions, filing taxes, preparing annual statements and much more. Besides, chartered accountants operating in Brighton and Hove offer an assortment of experience in tax law, cost accounting, management accounting and use of cloud accounting services. This way, you will benefit from prudent utilization of resources. As much as getting accountancy at a low price is a possibility, it is rare to find an experienced accountant that is priced lowly. However, a good accountant or team should provide you with accountancy services at an affordable price. A company that offers you the right services at the right price would be a great option. However, the amounts charged should not be given more attention that the deliverables.

As much as getting accountancy at a low price is a possibility, it is rare to find an experienced accountant that is priced lowly. However, a good accountant or team should provide you with accountancy services at an affordable price. A company that offers you the right services at the right price would be a great option. However, the amounts charged should not be given more attention that the deliverables.

dea is centered around the value of your home. In this case, your property’s equity is its true value less any outstanding loans. For instance, if your home is valued at $160,000 and you have $50,000 owed to a bank, your equity is $110,000. You are allowed to borrow against the equity in your house and at the same time halting payments on the house’s note. However, you will continue paying insurance and taxes on the property. The fact that the loan is meant for senior citizens, you must be at least 62 years to get the loan. Also, the home must be your primary residence.

dea is centered around the value of your home. In this case, your property’s equity is its true value less any outstanding loans. For instance, if your home is valued at $160,000 and you have $50,000 owed to a bank, your equity is $110,000. You are allowed to borrow against the equity in your house and at the same time halting payments on the house’s note. However, you will continue paying insurance and taxes on the property. The fact that the loan is meant for senior citizens, you must be at least 62 years to get the loan. Also, the home must be your primary residence. it helps you stay in your residence. Also, a non-borrowing partner can continue living in this residence, payment free, until he or she dies. For borrowers to live in the home until death, they are required to pay insurance and property taxes, offer it basic upkeep, and have a title in their names. When this loan is due, heirs are free to pay it up and continue keeping the residence, allow the bank to sell it, or sell it to pay the loan. You can discuss with the reverse mortgage specialists to know the best option for you.

it helps you stay in your residence. Also, a non-borrowing partner can continue living in this residence, payment free, until he or she dies. For borrowers to live in the home until death, they are required to pay insurance and property taxes, offer it basic upkeep, and have a title in their names. When this loan is due, heirs are free to pay it up and continue keeping the residence, allow the bank to sell it, or sell it to pay the loan. You can discuss with the reverse mortgage specialists to know the best option for you.

ng online companies, Birch ranks as the 3rd Gold IRA Company with a rating of 4/5 according to 2GOV.org, closely following Regal Assets which comes first with 5 out of 5 stars.

ng online companies, Birch ranks as the 3rd Gold IRA Company with a rating of 4/5 according to 2GOV.org, closely following Regal Assets which comes first with 5 out of 5 stars. h Gold Group could be the fact that even though it has been given impressive ratings from BBB, BCA, TrustLink and 2GOV.org, the number of reviews is not that big. For instance, TrustLink rates both Birch Gold and Regal Assets 4.9/5 stars. However, the rating for Regal Assets is based on a whole 595 reviews, while Birch Gold’s rating is only based on 45 reviews.

h Gold Group could be the fact that even though it has been given impressive ratings from BBB, BCA, TrustLink and 2GOV.org, the number of reviews is not that big. For instance, TrustLink rates both Birch Gold and Regal Assets 4.9/5 stars. However, the rating for Regal Assets is based on a whole 595 reviews, while Birch Gold’s rating is only based on 45 reviews.

ost by looking at the spreads that they display. Spreads are naturally substantially more important if you are scalping and day trading, however, for those forex traders who hold open long positions, spreads are not something that you ought to be worried about. You should consider the spreads of the brokers in the IC Markets to trade with the best ones who won’t exploit you.

ost by looking at the spreads that they display. Spreads are naturally substantially more important if you are scalping and day trading, however, for those forex traders who hold open long positions, spreads are not something that you ought to be worried about. You should consider the spreads of the brokers in the IC Markets to trade with the best ones who won’t exploit you. unding methods

unding methods

l for your situation or not, you will want to make sure you are dealing with a company that can find a solution that is best for you and your situation. If you think an IVA is your best option, then approach some specialists that have a good reputation, get some feedback from a couple of companies and see who can offer you the best deal for paying back your deal, with the lowest monthly cost and the least amount of time required paying that price.

l for your situation or not, you will want to make sure you are dealing with a company that can find a solution that is best for you and your situation. If you think an IVA is your best option, then approach some specialists that have a good reputation, get some feedback from a couple of companies and see who can offer you the best deal for paying back your deal, with the lowest monthly cost and the least amount of time required paying that price.

So because these smokeless cigarettes are legal and have no tobacco in them, you can smoke them where ordinary cigarettes are not allowed places such as clubs, restaurants or may be at your workplace. One more highlighted feature of smokeless tobacco is healthy for the user but is harmless to the people in the surrounding of a smoker as well.

So because these smokeless cigarettes are legal and have no tobacco in them, you can smoke them where ordinary cigarettes are not allowed places such as clubs, restaurants or may be at your workplace. One more highlighted feature of smokeless tobacco is healthy for the user but is harmless to the people in the surrounding of a smoker as well. By far the most common type and arguably the most active category of quit smoking products are those containing nicotine. Nicotine is the primary addictive drug in cigarettes and what makes it so hard for some people to stop.

By far the most common type and arguably the most active category of quit smoking products are those containing nicotine. Nicotine is the primary addictive drug in cigarettes and what makes it so hard for some people to stop.

Banks draw their list of defaulters, and this information is available to all their branches. This information is looked into when a person applies for a loan. The information is then used in addition to the CIB score and the credit report provided by the CRB.

Banks draw their list of defaulters, and this information is available to all their branches. This information is looked into when a person applies for a loan. The information is then used in addition to the CIB score and the credit report provided by the CRB. While lending money to an applicant, the banks will add all the existing outstanding loans from all the banks. This will help in determining the amount an applicant is eligible for. Then the ratio of loan to income is calculated by the bank before extending a loan.

While lending money to an applicant, the banks will add all the existing outstanding loans from all the banks. This will help in determining the amount an applicant is eligible for. Then the ratio of loan to income is calculated by the bank before extending a loan.

This is by far the most efficient strategy on how to

This is by far the most efficient strategy on how to  The real estate industry is a very lucrative one, and you can easily make tons of money in short periods of time if you have great sales skills. There are two major ways on how you can enter this industry.

The real estate industry is a very lucrative one, and you can easily make tons of money in short periods of time if you have great sales skills. There are two major ways on how you can enter this industry.